An interview with SATISH SANPAL: The CHAIRMAN OF ANAX HOLDING

Staff Report

Satish Sanpal, Chairman of ANAX Holding, is a visionary entrepreneur whose diverse portfolio spans multiple sectors, including real estate and hospitality. His ventures reflect his global, exceptional market insight, innovative strategies, and commitment to excellence across all industries he enters.

1. What has been the impact of Mr. Sanpal’s entrepreneurial journey on strategic investment decisions and innovation?

My entrepreneurial journey is marked by a clear vision of identifying emerging market trends and capitalizing on strategic investment opportunities. As Chairman of ANAX Holding, I drive growth and innovation through dynamic leadership, guiding diverse ventures across sectors with a focus on adaptability, sustainable development, and adherence to excellence in each project we undertake.

2. How crucial is aligning investment strategies with long-term business goals?

With extensive experience in investment management, I can vouch that aligning investment strategies with lasting goals is essential for enduring success. ANAX Holding embodies this holistic approach by integrating diverse ventures under a unified vision ensuring each investment not only meets current market demands but also aligns with our principles of continued growth and resilience in an ever-evolving economic landscape locally and globally.

3. How does Mr. Sanpal’s leadership embody persistence and integrity values?

My leadership is firmly grounded in the principles of persistence and integrity. As Chairman, I am committed to embodying these values across every endeavor as they shape my approach to all ANAX Holding subsidiaries and are fundamental to building and maintaining a reputation based on trust.

4. What are your future expansion plans?

Our plans are highly ambitious, with an anticipated 15% growth in our investment portfolio by the end of 2024. We are also launching ANAX Hospitality, which will focus on delivering exceptional guest experiences through innovative and authentic F&B offerings.

Having largely achieved our initial vision by diversifying investments and seizing new opportunities in a dynamic environment, ANAX Developments is preparing to unveil three pioneering projects in Meydan, Al Furjan, and Al Warsan later this year.

5. Can you share your vision for the future of ANAX Developments? How does “Vento Tower,” ANAX Developments’ debut project in Business Bay, stand out from the competition?

Our vision for ANAX Developments is to set new standards in urban living by delivering exceptional, accessible luxury residences with a firm commitment to upholding environmental standards. Vento Tower, our debut project in Business Bay, distinguishes itself with a five-star hotel-style lobby, 24-hour concierge service, and security, offering unparalleled comfort.

6. How do Dubai’s tax advantages impact real estate investment?

Dubai offers substantial tax benefits for real estate investors, as the city doesn’t charge direct property tax but instead implements a monthly “housing fee” and a 4% transfer fee. A recent report from Knight Frank and EY shows that Dubai’s property fees are among the lowest globally, at 3.6% over five years, just behind Monaco, making Dubai a highly appealing choice for both investors and residents.

7. In your opinion, is Dubai’s short-term rental and holiday homes market experiencing growth?

Indeed, there is exponential growth seen in this segment. According to AirDNA, apartments dominate the market, comprising 65% of listings, while luxury villas make up 26%. Furthermore, it’s the city’s diverse, high-quality accommodations and prime locations that contribute to its appeal, driving increased demand and market expansion.

8. Dubai is known for its luxury real estate at all levels, but it also provides affordable housing options. How do you believe the city has successfully balanced both sides of the market?

Dubai has effectively balanced luxury and affordable housing by promoting diverse developments that cater to all income levels. According to Allied Market Research, the global affordable housing market is projected to grow from $52.2 billion in 2021 to $84.7 billion by 2031. Dubai Land, for example, offers quality living with annual rent apartments averaging AED 55,000. As the global affordable housing market expands, Dubai’s innovative approach supports sustainable growth and inclusivity, while reinforcing its reputation for excellence in real estate.

9. What investment opportunities does ANAX Holding foresee in emerging markets?

ANAX Holding is actively exploring investment opportunities in emerging markets where growth potential is significant. Our focus includes sectors such as technology, green energy, and infrastructure, which are poised for expansion. By leveraging our expertise and market insights, we aim to identify high-potential ventures that align with our strategic goals and contribute to long-term value creation.

By Author

Beyond the Sale: Elevating Dubai’s Luxury Real Estate with a World-Class Hospitality-Driven Approach

AVLU Brings Aegean Flavors to Abu Dhabi: A New Dining Destination Inspired by Greece and Turkey

no related post found

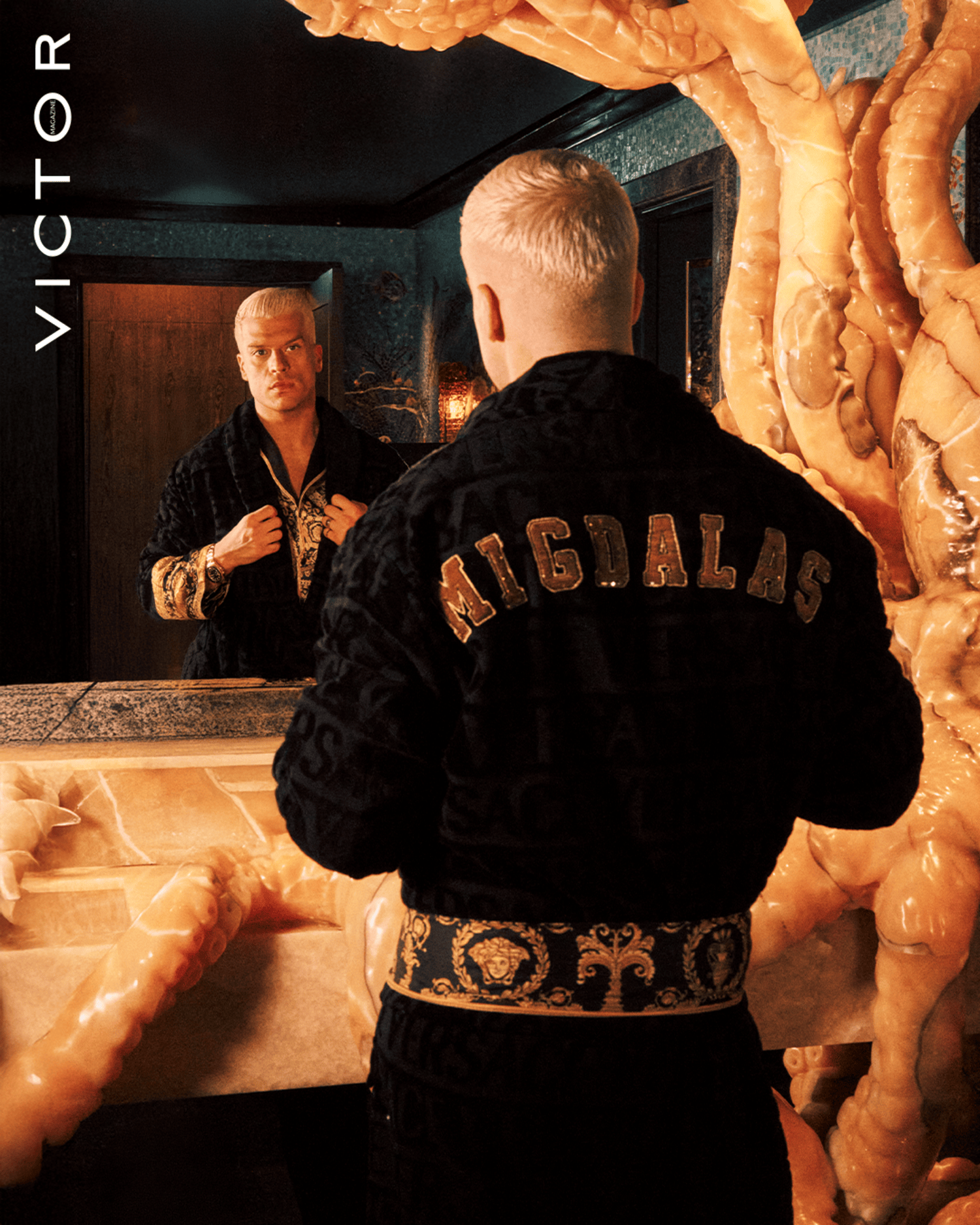

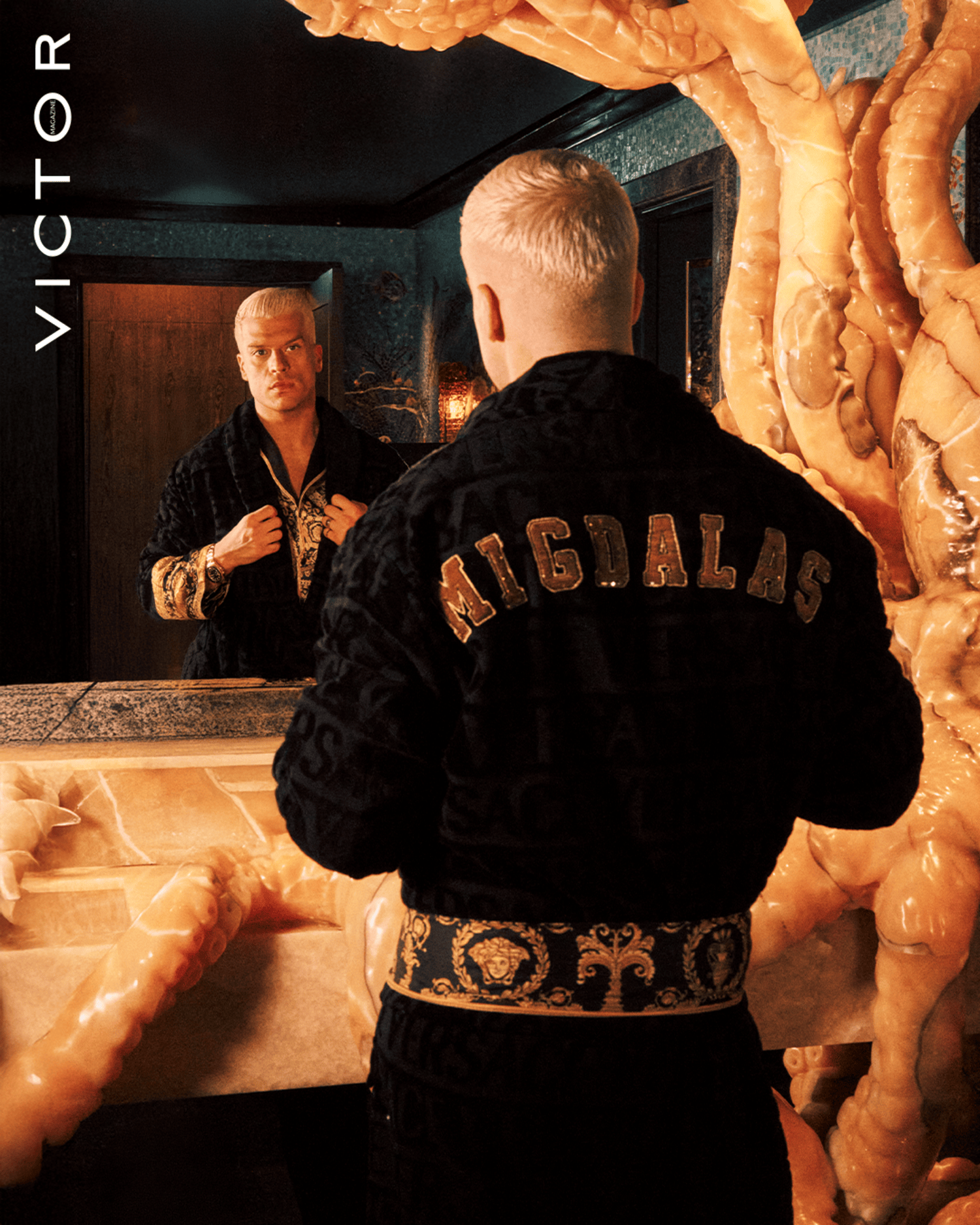

Beyond the Expected: John Migdalas on Today’s Luxury

“Flowers are our favorite F word!”

Indulging in Love and Flavor at Playa: A Valentine’s Day Delight

Beyond the Expected: John Migdalas on Today’s Luxury

“Flowers are our favorite F word!”

Indulging in Love and Flavor at Playa: A Valentine’s Day Delight