Mona Shehab is client relations manager at SmartCrowd

Staff Report

What is SmartCrowd? Who is behind it?

SmartCrowd is a digital real estate crowdfunding platform that allows you to invest and own a percentage of a property instead of having to purchase the property outright by yourself. A unique investment concept, SmartCrowd was founded by Siddiq Farid and Musfique Ahmed in 2018 as the first platform of its kind to be regulated and launched in the MENA region.

It enables you to jump onto the property ladder in a simple, hassle-free manner, all while earning potential monthly income from rental dividends, as well as potential capital gains when you decide to sell your property shares.

Why was the company started?

SmartCrowd was founded to enable all individuals to be able to purchase and diversify in real estate. Real estate has typically been an asset class that’s been reserved only for the wealthy, and we’re here to change that.

And is it only for wealthy investors?

No, as mentioned, SmartCrowd enables you to purchase real estate from as little as AED 500. We’ve gone a long way to making real estate an affordable asset class, and we’re seeing a variety of different investors on the platform – from property and investment gurus to individuals that are just starting out on their property investment journeys. The platform really allows you to diversify across different properties regardless of how ‘wealthy’ you are.

How many properties are in your portfolio?

We currently have over 100 properties in our portfolio, and the number keeps growing.

What about regulations – are investments protected?

As a company we are regulated by the Dubai Financial Services Authority (DFSA), so we are regulated by the same authority that regulates banks.

We have many measures in place for our investors to safeguard their investments and money. In terms of property investments, each property is held in a separate ‘SPV’ (Special Purpose Vehicle) which all investors are registered in at the DIFC (Dubai International Financial Center) as well as the Dubai Land Department. All documentation is provided to investors.

It differs from other investments you typically make, because you have a physical asset that you own, so even if anything was to happen to us, you would still legally own the property.

Is this just in the UAE?

We’re currently focused in the UAE, so all of our properties listed are here, but we welcome investors from around the world to invest.

Do you have plans to expand?

Definitely, we aim to expand geographically and start offering properties in other locations to our investors to help them further diversify their property portfolios. We’ve recently obtained our Saudi license, so that is one location that we are imminently planning to expand into. Other projects are also in the works.

What about technology – can you explain how the tech works?

The platform is quite straightforward. Once you register, you’ll be able to view a list of current investment opportunities, as well as our previously funded properties. You can then look at the details for each property, and if you like a specific property, you can quite simply invest in just a few clicks.

Is 2023 a good time to invest?

There will always be good investment opportunities across various asset classes regardless of what the general market is doing, and that is where having a team of experts to help guide you in your investment choices really makes a difference.

While we expect to see some uncertainty in the overall global market, we’re expecting that property investing will be seen as an important alternative to other underperforming asset classes.

That being said, if you’re able to invest a comfortable amount you shouldn’t be looking to time the market, but rather trying to get to put your money to work for you, and making investments on a consistent basis as a hedge against any potential ups and downs that investment cycles have.

Is 2023 a good time to buy a property? Or sell?

Generally, looking at the market, we’ve recently seen a definite surge in the real estate market in the UAE.

Looking closely, however, it will always depend on what the property in question is, certain areas have seen significant growth and others are yet to have seen the same growth.

The UAE real estate market is not as developed as certain other high-ranking cities, and this means its potential has also certainly not been filled – which is an exciting prospect for property investors.

The beauty of the platform is that this isn’t a factor you need to overly be concerned about, we’re constantly analysing which areas have the potential to provide you with the best opportunities and enable you to comfortably invest.

Where would you buy a property?

Dubai! I’m not just saying this, but I really see a lot of potential for the city. It’s not just a great place to live and work, but it’s also astonishing to see the transformation that is constantly happening here.

Dubai’s standard of living, rapid development, and the value of property still show a huge discrepancy and a potential for upward movement when you compare it to other major cities.

What makes a good investment property?

It’s typically quite difficult for individuals to differentiate between what makes a ‘good investment property’ and a property they would love to own or live in, I think the first part would be to take the emotional element out of it when you’re looking at property investing.

A good investment property is not necessarily the most luxurious, or the most popular area currently, but rather a combination of different factors. It’s also important to bear in mind there are two different elements of returns with properties – rental income, and potential capital gains on the unit itself when you come to sell.

So it will really depend on what strategy you are focused on, and as with any investment – how long you are willing to hold the investment.

On a micro level, you would look at the property itself of course, but then you would need to look at other elements. For example, what are the service charges you are paying for this property? What are the given rents currently, what are they expected to do, and how does this fair in relation to the cost of the property itself? If you’re buying an apartment – what are the occupancy rates in the building? How well is it built and maintained?

You’d then need to take it a step further, is there any regeneration expected in the area? How good is the infrastructure and community and are there any expected neighboring areas expected to then lift this current location?

That’s what’s great about our platform, all the research and number-crunching is done by a team of property experts who are analysing the market data and have knowledge of the market. So already, you’re at an advantage when you’re on the platform and looking at which properties have been selected – after that, it’s entirely your decision to look at all the research and data we present to make your own informed investment decision.

What makes a property luxurious?

I think there are so many different elements to this. You can theoretically have a luxurious property in the middle of nowhere, but with beautiful architecture or interior.

A more traditional parameter for a luxurious property, however, would probably combine this with a prestigious location, and I think Dubai in itself meets these criteria. It has so much going for it and we’ve seen how popular of a location it has become globally to live, work, and ultimately settle in for a sustained period.

About SmartCrowd

SmartCrowd is the MENA region’s first regulated real estate investments platform and a pioneer in bringing alternative investments to the mass market. SmartCrowd is excited to continue that mission and to expand the offering even further by giving everyone a chance to build well-diversified portfolios beyond just stock, bonds and cryptocurrencies. SmartCrowd’s mission is to level global income inequality by providing universal access to best-in-class rental property investments.

www.smartcrowd.ae

By Author

Beyond the Sale: Elevating Dubai’s Luxury Real Estate with a World-Class Hospitality-Driven Approach

AVLU Brings Aegean Flavors to Abu Dhabi: A New Dining Destination Inspired by Greece and Turkey

no related post found

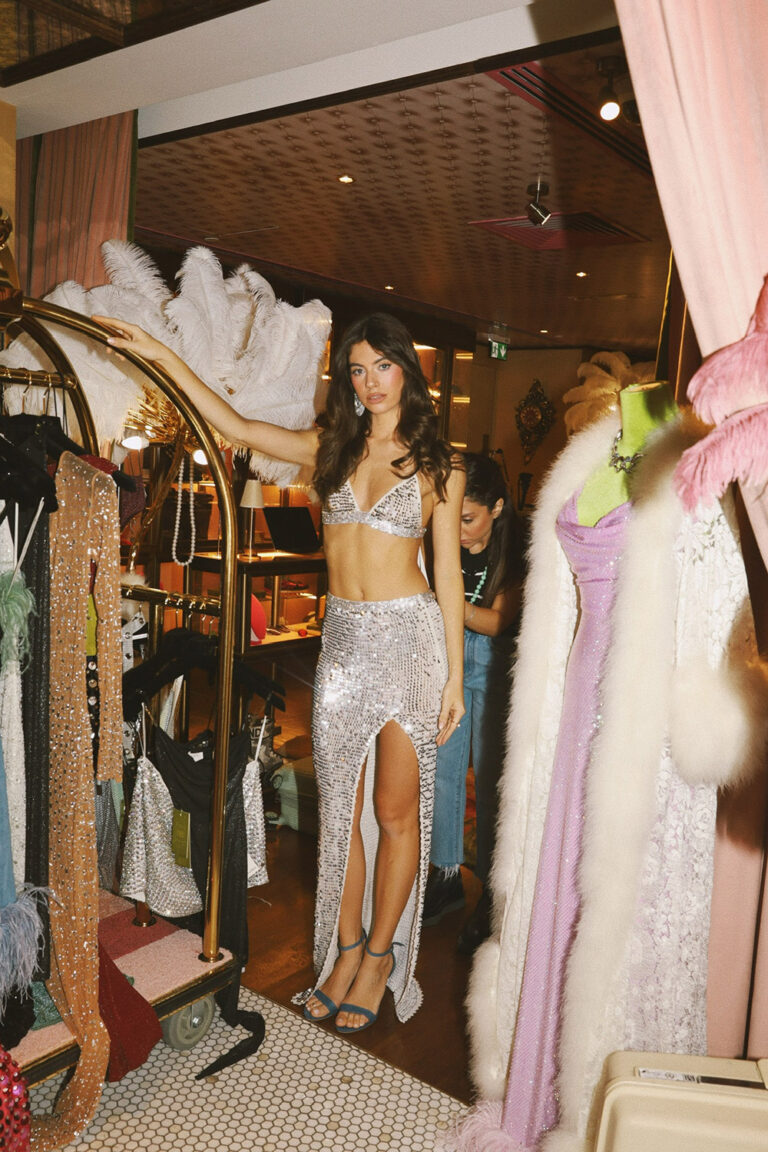

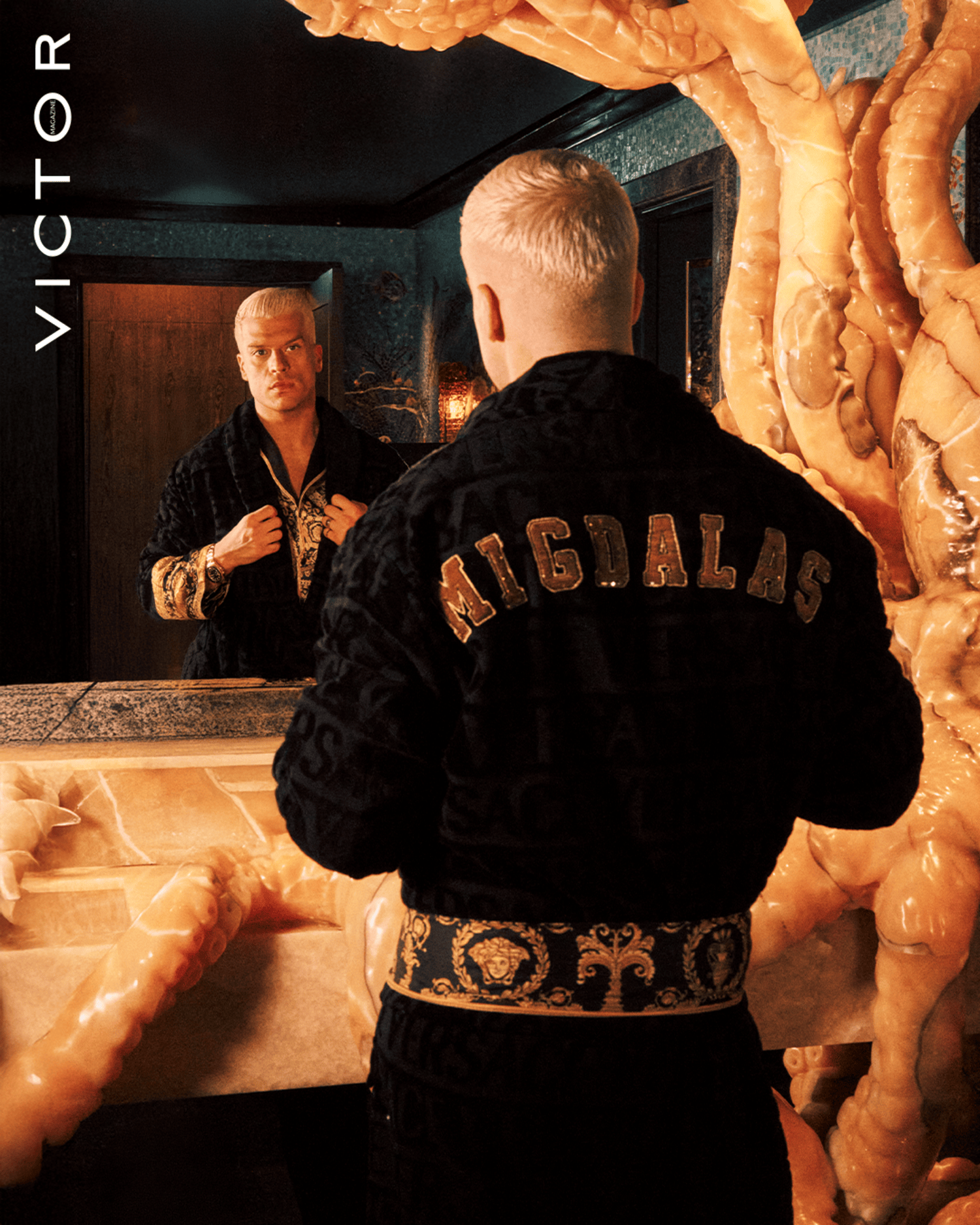

Beyond the Expected: John Migdalas on Today’s Luxury

“Flowers are our favorite F word!”

Indulging in Love and Flavor at Playa: A Valentine’s Day Delight

Beyond the Expected: John Migdalas on Today’s Luxury

“Flowers are our favorite F word!”

Indulging in Love and Flavor at Playa: A Valentine’s Day Delight