Satish Sanpal, Chairman ANAX Holding

Staff Report

Renowned businessman and entrepreneur Satish Sanpal is Chairman of, and the guiding force behind, ANAX Holding.

Sanpal’s diverse portfolio spans many sectors, encapsulated within ANAX Developments and ANAX Holding. These organisations come together under the umbrella of ANAX Group, reflecting Sanpal’s international ambitions and wide-reaching enterprise.

1. What, to you, constitutes luxury?

As Chairman of ANAX Holdings, everything we do as a company revolves around creating new benchmarks in the luxury lifestyle for people in the UAE. We are driven to deliver these paradigms that contribute to elevating modern life, underpinned by our first foray into Dubai’s exciting luxury property sector with VENTO Tower. On a personal level, luxury for me means chasing scarcity: enjoying rare automobiles, collecting rare books and manuscripts, and yachting.

2. And what makes a property luxurious?

Today, I believe what makes a property truly luxurious is having everything you need, and a property that is designed to the best standards, with the highest levels of fixtures and fittings with great consideration given to quality, space, and design. More space is a given, but we are taking luxury to the next level at VENTO Tower, with a 24-hour concierge service, an open-air cinema, a world-class gym and a five-start hotel-style lobby – it’s through these touchpoints that you can truly make a difference in one’s experience of elevated living.

3.Where are the most luxurious areas of the UAE, in terms of property?

We all know Emirates Hills is considered one of the best areas, along with the Palm Jumeirah villas, Jumeirah Bay, Al Barari, Dubai Hills and Jumeriah Golf Estate in Dubai, but VENTO Tower is in Business Bay, where we believe people can enjoy all the trappings of a very central urban location, while living in their own haven – an escape from the rigours of modern urban living. We also note a new chapter unfolding in lesser-explored territories, with Sharjah, Ras Al Khaimah, and Ajman emerging as hotspots for discerning investors seeking a unique blend of tranquillity, cultural richness, and untapped potential.

4.Who is buying luxury properties? Where are they from?

Bricks and mortar has always been viewed as a solid investment, and we are seeing global interest in Dubai, as a total of 56 ultra-luxury homes worth $2.27 billion were sold in the city in 2023, up from 28 properties worth $1.24 billion a year earlier. Also, sales of homes worth $25 million or more doubled in Dubai last year after some of the world’s wealthiest people snapped up homes in the Middle East’s business and tourism hub, according to property consultant Knight Frank LLP. People are seeking sound investments in well-designed and built properties, and Dubai has long bucked the trends in real estate. The UAE luxury market remains buoyant, attracting people for the luxury lifestyle, fantastic infrastructure, and ease of gaining residency, and of course the all-year round great weather. In terms of nationalities, most recent surveys show Indians, Europeans and Gulf nationals topping the luxury property investment charts.

5.What do you see as the trends in luxury property?

We are pursuing the trend towards more experiential living. Whereby modern investors and homebuyers in the UAE seek more than mere opulence – they yearn for a narrative, a strong sense of community and new experiences. The new era of luxury real estate is defined by properties that transcend traditional boundaries, offering a lifestyle that blends cultural richness with cutting-edge architecture and exclusive leisure facilities. It’s not just about the property, but the range of experiences that come with it. This shift towards experiential living reflects a deeper understanding of the desires of today’s discerning individuals. They crave not only the comfort of a luxurious home but also the enrichment of their lives through curated experiences, from cultural immersion in the community to personalised concierge services, catering to their every whim.

6. Is luxury property still a good investment?

Yes. Simply put in a world where we see constant fluctuation in the value of stocks, bricks and mortar represents a solid – literally and figuratively – way to invest your hard-earned money. Whether a purchase is your primary residence, a holiday home or an investment property, all the indicators suggest luxury property – which will always be scarce and in demand – is a good investment. Appreciation, tax benefits and liquidity are three watchwords to consider when looking into purchasing a luxury property.

7. How would you advise someone looking to buy a luxury property – what should they look for, and what are the most important factors to consider?

Firstly, it depends on the purpose of the purchase – there’s a large difference in intention if you are buying a forever family home, or a five-year investment property. Everyone is different, but luxury properties tend to be well built, and located in the best parts of a city or country.

Prioritise factors such as location, quality of construction, architectural design, amenities, customisation options, sustainability and long-term investment potential. By carefully considering these factors, you can ensure your luxury property investment meets your expectations for luxury living – and serves as a sound financial asset for years to come.

8. Do you think Dubai and the UAE are now synonymous with luxury property?

Most definitely. I think it’s down to the careful organic growth of the sector post-2008, since which time the UAE has taken carefully calculated steps to regulate and monitor the sector, ensuring international standards are met and often exceeded. The laissez-faire and continually strong economy here means the UAE is an attractive place for anyone looking to invest in international luxury property. As I mentioned earlier, our geographical location, tax and visa regime, infrastructure, lifestyle, and comparatively good property pricing structure make a UAE property purchase very attractive.

And size matters. Surveys have revealed that a million-dollar property in one of Dubai’s many upscale areas averagely offers around 1,130 square feet according to data gathered by real estate firm Knight Frank, which is almost five times larger than a comparable home in Hong Kong – and three times larger than one in London or Singapore.

9. And let us in on uber luxury – those one in a million properties – what sort of features do uber luxury properties include, and what sort of clientele?

Uber luxury to me means having the ability and wealth to create a truly bespoke property to your specifications. While space is important, I think these properties often include those personal ‘must haves’ like a recording studio, an observatory or a helicopter pad. What about a nightclub, a VR gaming room, a cinema or a meditation chamber?

In Dubai, we see so many oversized villas, with vast entertaining areas, multi-car parking and garages, and lush gardens.

An uber-luxury property should include several areas to relax in, and even functional aspects come oversized as normal, from wet rooms to walk-in wardrobes.

Today, we see a move towards the blending of home and work life – so you might expect a bespoke uber luxury property to include a workspace, or even a fully fledged office suite, And the pandemic shifted people’s mindsets towards spending more leisure time at home. This might include tennis courts, swimming pools, advanced home gyms and even things like indoor and outdoor games centres, a cinema or music room.

As far as clientele go, in this exalted sector we are talking corporate leaders, and those who have made their fortunes in the likes of bitcoin or investing, for example.

By Author

Beyond the Sale: Elevating Dubai’s Luxury Real Estate with a World-Class Hospitality-Driven Approach

AVLU Brings Aegean Flavors to Abu Dhabi: A New Dining Destination Inspired by Greece and Turkey

no related post found

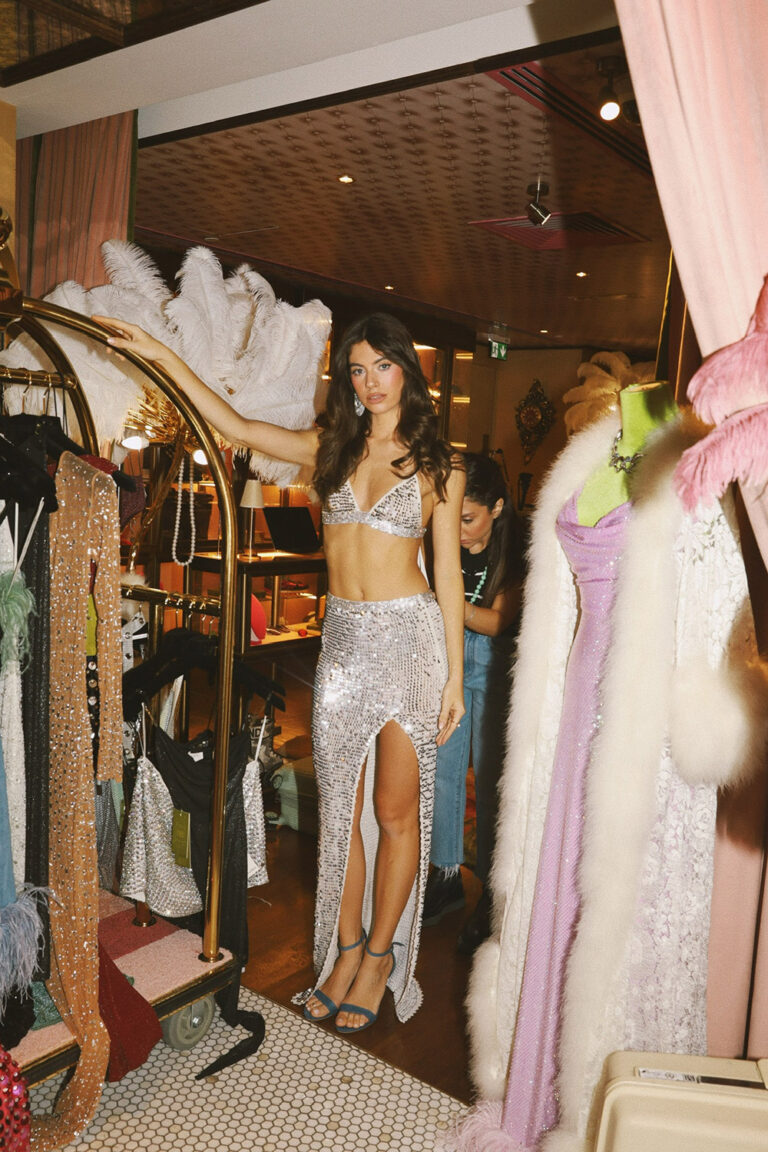

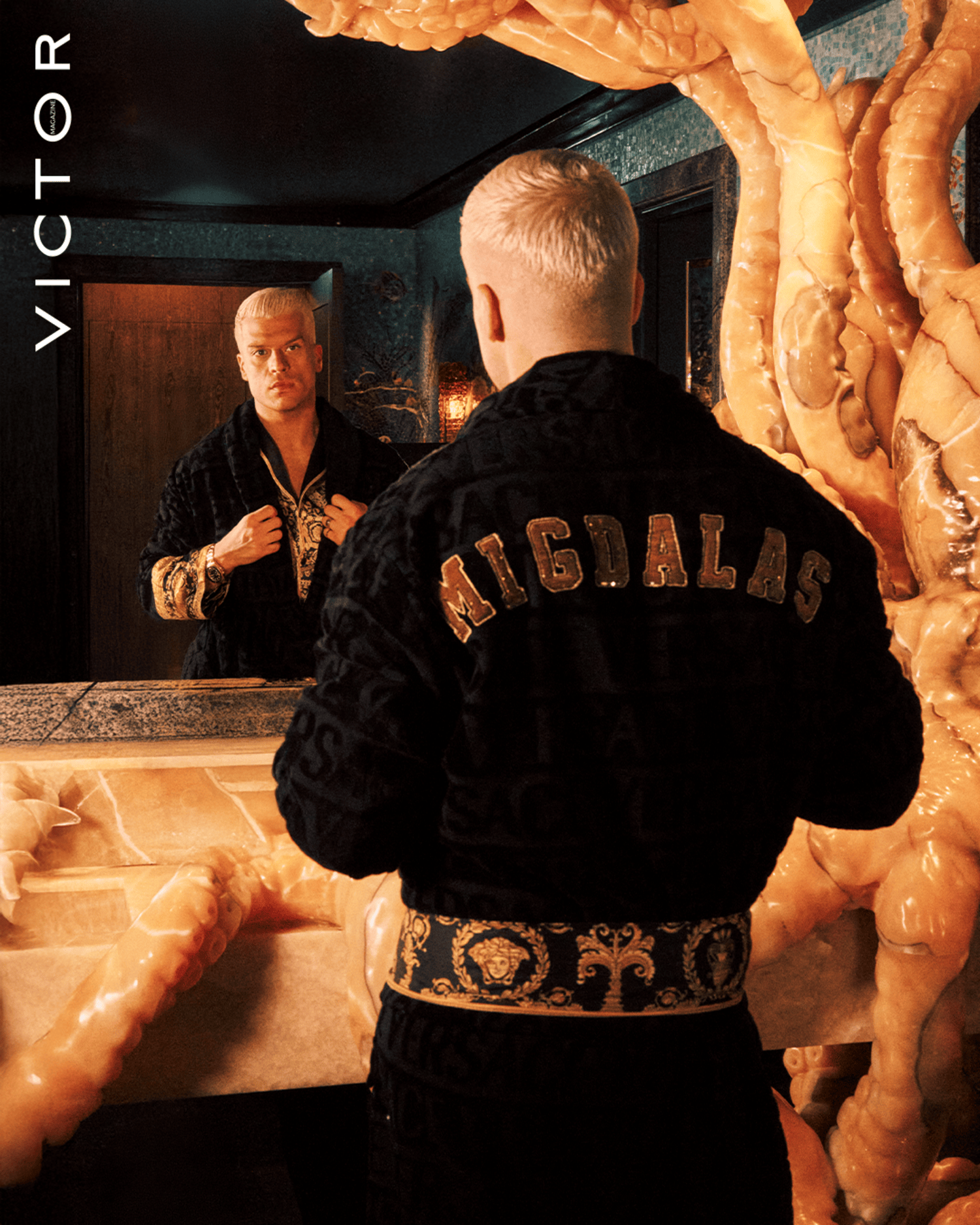

Beyond the Expected: John Migdalas on Today’s Luxury

“Flowers are our favorite F word!”

Indulging in Love and Flavor at Playa: A Valentine’s Day Delight

Beyond the Expected: John Migdalas on Today’s Luxury

“Flowers are our favorite F word!”

Indulging in Love and Flavor at Playa: A Valentine’s Day Delight